AML Compliance

AML Compliance is complex, to say the least. Whether it be the development of AML related policies, AML Quality Control testing, Updates to Rules/Thresholds, or Investigations, there are a lot of moving parts and large regulatory requirements. Meeting those requirements while ensuring compliance can be overwhelming and difficult to track.

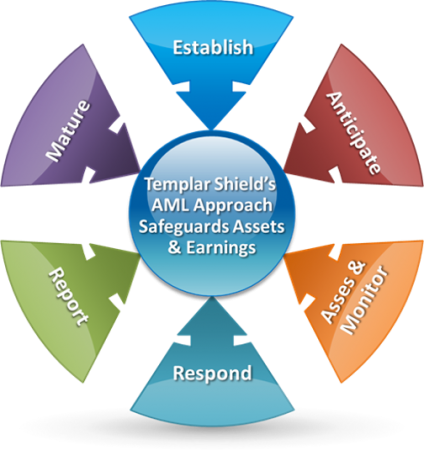

Templar Shield’s AML Solution provides an integrated and holistic approach to Anti-Money Laundering Compliance, including integration to existing AML Softwares, allowing for centralizaiton of AML Compliance Management. Through our solution, you are better equipped with a holistic view of your AML Program and its compliance status.